How to Handle I-140 Ability to Pay Cases (and RFEs)?

One of the key aspects of an I-140 immigrant petition is proving the employer’s ability to pay the offered wage not only as of the priority date (for most cases this is the date of filing of the PERM Labor Certification) but also until the beneficiary obtains permanent residence – a period that can span multiple years for some beneficiaries, especially those from India and China. This article seeks to explain how to best document the employer’s ability to pay in an initial I-140 petition filing or in response to a USCIS Request for Evidence (RFE) or Notice of Intent to Deny (NOID) .

Legal Requirements for Proving Ability to Pay

The ability to pay must be demonstrated for each I-140 petition:

Evidence of this ability shall be either in the form of copies of annual reports, federal tax returns, or audited financial statements. In a case where the prospective United States employer employs 100 or more workers, the director may accept a statement from a financial officer of the organization which establishes the prospective employer’s ability to pay the proffered wage.

8 CFR 204.5(g)(2) (emphasis added).

In addition to the primary evidence, USCIS may accept secondary evidence to prove ability to pay. Such secondary evidence may include evidence of actual payment of the offered wage (or higher) to the beneficiary, bank statements, profit and loss statements, personnel records, financial projections, and related.

Also, as noted, the petitioner must demonstrate this ability at the time the priority date is established and continuing until the beneficiary obtains their lawful permanent residence.

To summarize, these are the documents that USCIS expects to see in support of the ability to pay with each I-140 petition:

| Primary Documents (Must Include At Least One): |

Secondary Documents (May Include Combination): |

|---|---|

| – Annual report, – Federal tax return, or – Audited financial statements. OR, – Statement from financial officer attesting to ability to pay if employer has 100+ employees. |

– Evidence of actual pay: W-2s, pay records – Bank statements – Profit and loss statements – Personnel records – Financial projections – Contracts, statements of work, etc. – Business plans |

Use of Net Income to Show Ability to Pay

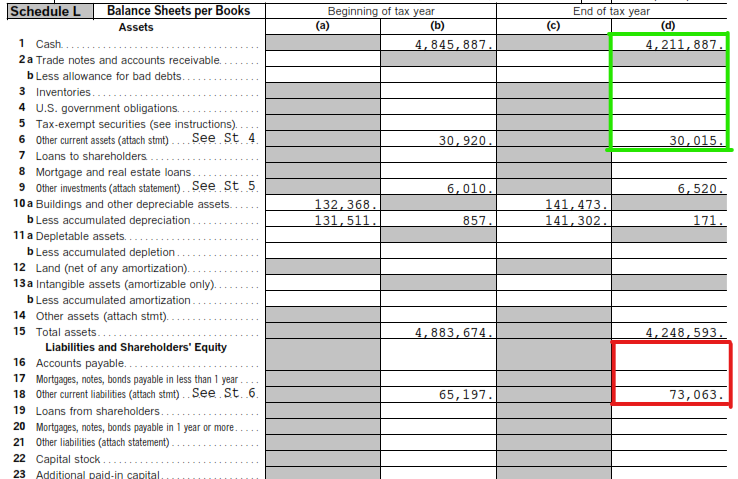

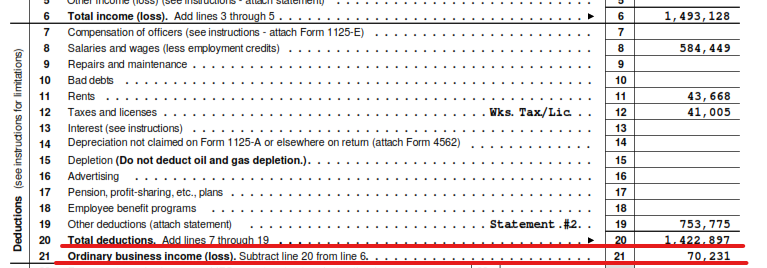

USCIS would look first at the tax return (or the annual report/audited financial statements) to determine whether the employer’s income from the relevant tax return is sufficient. While tax forms vary, normally USCIS would look at the total business income (loss) figure on the tax return which represents the net income and not on the total (gross income). See example from a recent IRS Form 1120-S,U.S.Income Tax Return for an S Corporation:

This example shows where to look to identify the net income on a tax return (location and wording would vary based on the form and the filing entity’s specific tax structure):

If the net income figure is more of the I-140 offered wage this is generally proof that the employer has the ability to pay the offered wage.

In the illustration above, the net income figure of $70,231 would be sufficient to show ability to pay if the offered wage amount, for example, is $65,000.

Evidence of Payment of Salary to Show Ability to Pay

Another way to show ability to pay is to demonstrate that the employer is paying actual salary to the beneficiary which is more than the offered wage. A 2004 USCIS Memorandum (Yates Memorandum) guides the service to make a positive determination where the employer can document that it is employing the beneficiary and paying salary equal to or exceeding the offered wage. Normally, as permitted by 8 CFR §204.5(g)(2), the employer would include the beneficiary’s historical pay records (pay stubs, W-2s) to document this. Note that it is important to make it clear explanations and calculations of the salary payments- for example, calculate the annual salary based on the correct pay schedule, exclude non-salary compensation, and similar.

Use of Net Current Assets to Show Ability to Pay

If the employer’s net income or payment of actual salary are not sufficient to demonstrate ability to pay, the employer has another way to use the tax return to do so. Pursuant to a 2004 Memorandum, USCIS should make a positive ability to pay determination where the employer’s net current assets are equal to or greater than the offered wage.

Net current assets are the difference between the employer’s current assets (Schedule L, lines 1 through 6) and current liabilities (Schedule L, lines 16-18).

A successful net current assets argument will have to demonstrate that the employer’s net current assets, as shown on the tax return and as calculated, exceed the offered wage. We recommend using spreadsheets and other illustration aids to present this complex information to USCIS.

Combining Actual Paid Salary and Financial Records to Show Ability to Pay

In cases where the actual salary, the net income, and the net current assets are all lower than the offered wage, it may be possible to combine the salary paid with the employer’s tax return figures to make an argument that the payment of salary, combined with net income or net current assets are sufficient to show ability to pay.

While not clearly spelled out by the USCIS guidance or the Yates Memorandum, our office in the past has successfully been able to combine salary paid (shown by pay records) and net income or net current assets (shown by and calculated from the tax return) to make a successful argument for ability to pay.

For example: the PERM offered wage is $100,000 per year. The beneficiary is employed by the petitioner at actual current salary of $80,000. The petitioner’s net income is $65,000 per year and their net current assets are $85,000. It may be possible to argue that the combined actual salary of $80,000 plus the net income of $65,000 are sufficient to show ability to pay the offered wage of $100,000.

Important note: This argument is not clearly allowed by USCIS guidance but it has worked in our prior experience. Certainly not guaranteed to work in all cases.

Other Evidence and Arguments to Show Ability to Pay

USCIS allows petitioners who cannot show ability to pay in any of the ways described above to still make an argument based on their particular situation. Under a case called Sonegawa, USCIS allows employers who operate at a loss to submit documentation to show that the petitioner will have the potential to pay the offered wage in the future. For example, a research-based company may not be able to show income for several years, but if the employer is able to provide evidence of current and anticipated funding or profitability in the future, USCIS may make a positive ability to pay determination.

This is a very subjective determination and requires strong and credible documentation of future profitability such as contracts, business plans, projections, and others.

Ability to Pay for Multiple I-140 Beneficiaries

When USCIS sees that a petitioned has filed multiple petitions for multiple beneficiaries (currently, or in the recent past), they may also request that the employer has continuing ability to pay the offered wage not only for the current petition beneficiary but also for ALL beneficiaries for whom an I-140 petition has been filed from the time of such other petition’s I-140 priority date until the time each other beneficiary obtains their permanent residency. For employers who have any notable number of I-140 petitions, this RFE request , if issued by USCIS, requires a fairly complex analysis of prior I-140 petitions, priority dates, historic payroll and actual payment of wages and financial analysis for a period of several years.

While RFEs seeking ability to pay for multiple I-140 beneficiaries are not extremely common, if issued, they may a significant burden on an employer. For example, an employer who has filed fifteen I-140 petitions for beneficiaries from India over a course of 5 years will need to provide payroll records for each of the fifteen beneficiaries for the last 5 years, in addition to the employer’s financial records (tax return, audited financials, etc.) for the last 5 years.

All of this information should then be carefully analyzed and presented to USCIS in a multi-page spreadsheet showing clear calculations that the employer retains ability to pay the offered wage for each of these beneficiaries. Needless to say, this kind of RFE is extremely burdensome and may reveal lack of ability to pay for at least some of the other prior I-140 beneficiaries.

When to Analyze and Consider the Ability to Pay

There are four key period during each PERM/I-140 case when the employer and its lawyers should evaluate the ability to pay. This analysis should be conducted with respect to the particular case but also the employer should also consider the impact on the ability to pay for all of its I-140 beneficiaries.

First, the ability to pay factor should be considered at the initial steps of the PERM Labor Certification or when the PERM/Green Card job profile is being drafted. The position description and its PERM requirements should be carefully drafted and evaluated based on the prevailing wage levels at that time.

Second, once a prevailing wage determination is issued by the Department of Labor, the employer should again and more specifically evaluate whether it is paying the offered wage, whether it can continue to do so in the future and whether it has had and will have an ability to show consistent net income or net current assets on its tax return.

When a PERM is certified and the employer is ready to file I-140, very specific documentation, as illustrated in this article, should be prepared and included with the I-140 petition in order to avoid a request for evidence or a notice of intent to deny on the I-140 petition.

Finally, when the employee’s priority date is current and the employer signs off on the I-485 Supplement J, the employer should again consider whether it still has the intent and ability to pay the offered wage. While it is very unusual for USCIS to “test” the ability to pay at the I-485 stage, it is still possible under USCIS’s effort to determine the bona fide nature of the position.

Attorney Assistance with Preparing RFE Response

We have been very deeply involved in the I-140 ability to pay issues and, having handled thousands of such cases, we feel that we have been able to understand the facts and documents USCIS adjudicators expect to see in order to issue an approval. Our office will be happy to provide consultations or assistance with responding to this (or other) kind of RFEs. If you would like to schedule a consultation with an attorney to discuss a specific case (but perhaps without engaging us to help with the RFE filing), we offer phone consultations.

We are also happy and available to assist with a more comprehensive RFE response representation. Please feel free to complete this RFE inquiry form and we will be happy to provide thoughts and, if applicable, a quote for our legal assistance.

Conclusion

The I-140 ability to pay issue (and RFE reason) is a factor that has been around for many years but we are still seeing a significant number of RFEs and NOIDs in a wide array of I-140 petitions. Many of these RFE/NOIDs are totally preventable in the first place and, unfortunately, we have been approached by clients whose I-140 cases are extremely difficult to approve because the employer did not do a proper prevailing wage/ability to pay analysis earlier in the process.

Our office will continue monitoring related developments and provide updates. Please do not hesitate to contact us if we can be of any help in preparing or otherwise assisting with PERM/I-140 petitions including handling ability to pay RFEs. Also, please feel free to subscribe to our free weekly newsletter to obtain developments on this and related topic.

Related News and Articles

The Capitol Immigration Law Group has been serving the business community for over 15 years and is one of the most widely respected immigration law firms focused solely on U.S. employment-based immigration. Disclaimer: we make all efforts to provide timely and accurate information; however, the information in this article may become outdated or may not be applicable to a specific set of facts. It is not to be construed as legal advice.